France-Russia Automotive

N° 3

![]()

Price : 10 € TTC

France-Russia Automotive (Auto Franco-Russe) is an economic newsletter focusing on the development of the Western automotive groups’ business in Russia. France-Russia Automotive is distributed both on paper and electronically. To receive the next issues for a free trial you only need to subscribe on our website: www.autofrancorusse.fr. France-Russia Automotive is published by Agence du Fil SARL Company, whose publications are devoted to the Franco-Russian trade.

| THE MOSCOW MIMS 2007 | l |

| a partial success | |

| THE LIST OF ASSEMBLERS | l |

| will be closed | |

| RENAULT AND AVTOVAZ | l |

| are still discussing | |

| AUTOMOBILE UNIONS | l |

| are trying to be heard | |

| GAZ | l |

| "we are open to all partnerships!" | |

| SIBUR – RUSSKIE SHINI | l |

| is aiming at international markets | |

| THE BEST SALES | l |

| of foreign brands | |

| SECOND-HAND | l |

| European cars fetch good prices | |

| THE MOSCOW CAR FLEET | l |

| is renewed by foreign brands | |

| TYPICAL PURCHASER | l |

| the average age of a new car buyer is 37 years old | |

| TAGAZ | l |

| 'We require lower prices from local suppliers than those of the Koreans' | |

| DELPHI | l |

| 'We are also relying on future implantations!' | |

| SOK | l |

| 'Our 50,000 employees are ready to learn!' | |

| IRAN KHODRO | l |

| 'We plan to create our own subsidiary in Russia' | |

| BRIDGESTONE | l |

| cultivates a good citizen image | |

| AMTEL-VREDESTEIN | l |

| the difference between it and its Russian equivalents | |

| VIANOR | l |

| 'Adapt your programmes into this market!' | |

| IN BRIEF | l |

| the latest news of the market | |

| AGENDA | l |

| the next events of the automotive market |

COLUMN

Have you heard of the Samand?

Me neither, I had never heard of it before I had the opportunity to

admire this saloon car and the other models of the Persian manufacturer

Iran Khodro during the MIMS show that was held at Moscow in early

September The first models have just arrived in Moscow after crossing

the Caspian sea.

I was also able to relax in the rear seat of a Hover, a luxurious

10-seater limousine from the Chinese manufacturer Great Wall Motor

Company, a distant but not embarrassing copy of limousines made in the

USA.

What really surprised me from the moment I first entered the MIMS show,

was the low presence of European manufacturers this year, especially the

French: no Peugeot, no Citroën, no Renault, not even Michelin. On the

other hand, emerging manufacturers were very evident: they had reserved

imposing stand sizes (especially when you know the price) and were

exhibiting an equally large number of models whilst offering

demonstrations aimed at attracting both customers and the press with a

true marketing approach.

When you know that Iran Khodro produced 455,000 vehicles during the

first 10 months of 2007, an increase of 10%, and that it plans to export

25% of its production by 2010, you gat an idea of the progress that they

have made since the distant past when one of the rare Chinese mini-cars

was exhibited in the show's car park and created great amusement when

the door joint fell off, and the noise of its door shutting being

reminiscent of an old Citroën.

The Koreans also made us smile during the early 70s. We don't need to be

reminded of the position their industry enjoys nowadays. Perhaps the

Chinese and Persians are preparing us for another lesson in humility.

Alain Bastid

NEWS

THE MOSCOW MIMS 2007: A PARTIAL SUCCESS

'The progression of sales of

foreign cars, at 67% last year, represents an extraordinary performance

which we are unlikely to see in another country. We think that Russia

will be the world's biggest automobile market by 2012.' This is the

opinion of Henrik Nensen, chairman of Ford Russia and chairman of the

car manufacturers committee within the Association of European Business

in Russia. He was speaking at the MIMS-Interavto 2007 show at the end of

August in Moscow.

The show unites about 800 companies from 15 countries. Much smaller than

MIMS-Interavto 2006 and much less representative: apart from local car

and equipment manufacturers and a few international companies, it was

above all a show for the Chinese, Turks, Iranians and Indians. The

organisers explain that they wanted to promote a true international

dimension every two years in the same way as the world's other major car

shows. They have given us a date for next year and promised a show that

will be much bigger in 2008.

The companies were virtually absent from the show. 'I am the only French

company in this building compared to the large village where you can

find all the Italians, the Germans in another without mentioning the

Spanish...' regretted Alexandre Mizrahi, director of Klaxcar France,

agent for Klaxon. Only to add: 'I am at this show for the second time. I

have several small clients in Russia. The Russian market is complicated

and we don't get much help.' Alexandre Mizrahi, in common with many

French companies, hopes to find more support next year for MIMS 2008.

THE LIST OF ASSEMBLERS WILL BE CLOSED

The Minister of Economy announced in mid-November 2007 that he will stop signing contracts providing fiscal advantages for industrial assembly of foreign branded vehicles. Renault, Volkswagen, General Motors, GM-Avtovaz, Nissan, Toyota, Ford, Suzuki, PSA, Hyundai, and the Ukrainian assembler Bogdan plus local companies Gaz, Avtovaz, Izhavto (SOK), ZMA and Severstal-Elabuga (these last two are part of the Severstalavto group), have obtained the advantage of tax reductions especially when importing parts required for assembling. Several submissions have apparently been refused including the local company Ouralskaya Avtomobilnaya. Surprise, China's Great Wall is not included in the list of beneficiaries. After two years of unfruitful attempts and despite support from Guerman Greff, Minister of Economy until September 2007, the anti-Chinese lobby amongst Russian industrialists and the civil service have beaten the project. However, it is possible that the Chinese company has not had its last word. Russian administrative decisions often change over time.

RENAULT AND AVTOVAZ ARE STILL DISCUSSING

Discussions between Renault and Avtovaz are not being called off according to Michel Gornet, deputy General Manager and Manufacturing and logistics Director at Renault, in an interview with the Russian press in September 2007. In the meantime, Renault aims to increase its production capacity on the existing Avtoframos site at Moscow. Whilst speaking about models adapted to the market, Michel Gornet spoke of the virtues of the Logan. Initially designed to be made in Romania with a minimal automation rate and components using simple technologies, this model is ideally suited to Russian industrial conditions where labour remains cheap. The lack of automation on assembly lines in Moscow means that Renault can offer its vehicle at a very competitive price on the local market.

According to data unveiled in mid-December 2007 an agreement has been found. Renault should acquire 25% of Avtovaz, to produce at least one new low cost model. We will have more information on this project in our next French-Russia automotive edition.

AUTOMOBILE UNIONS ARE TRYING TO BE HEARD

The Avtovaz factory at Togliatti

was hit by another strike on August 1st 2007 Nearly 2,000 bodywork and

mechanical assembly workshop workers stopped the assembly lines for 4

hours. This is not the first industrial action amongst this leader of

the local car manufacturing industry. However, the true causes of the

strikes are rarely known with any detail.

Carine Clément, a French sociologist working for the Institut de

l’Action Collective at Moscow has just published the results of a survey

conducted with striking and non-striking workers. According to about

twenty employees, the strike was due to pay which had fallen suddenly

this year and could be as much as 50% of its previous level.

To understand this, you should be aware that the Avtovaz factory uses

115,000 employees to produce 700,000 cars per year. This is about six

vehicles per employee per year. This is five to eight times less than in

international manufacturers' factories. This low productivity justifies

low salaries, in the range of 230 - 380 dollars (6,000 - 10,000 roubles)

for production workers. Consequently many workers prefer doubling their

working time and work two shifts to obtain a final salary in excess of

500 dollars per month.

According to the unions, salaries and social charges represent about

12.33% of a vehicle's production costs. Apparently no salary increase is

planned at present. This is because the Avtovaz ranges are losing ground

in the market to western competitors and there are regular troughs in

the demand. At the start of2007, vehicle stocks in the factory and at

distributors exceeded 100,000 units.

Rossoboronexport, the public arms sales company and main shareholder in

the factory for the last two years, is too involved in the workings of

the federal government to announce major job losses which would be

politically unpopular especially on the eve of local and presidential

elections. It is doubtlessly for this reason that Avtovaz's new owner is

limited to half measures. Initially, it was decided that employees could

no longer receive two salaries. This caused a sudden drop in revenues.

But it’s a good bet that the measures will not be limited to this.

Confronted by competitive pressure, Avtovaz will soon be obliged to

reduce its employee numbers possibly by re-adjusting the pay rates.

Currently, Avtovaz workers are eyeing western manufacturers present in

Russia. The Ford Motors factory in the St Petersburg region is often

mentioned: average pay is about 500 - 900 dollars, according to the

unions. This does not protect the manufacturer from industrial action: a

24-hour strike in February and the beginnings of a strike in November.

It appears that motor industry unions want to be heard.

EXPERIENCES

GAZ: “WE ARE OPEN TO ALL PARTNERSHIPS!”

The group GAZ originated from Nijni Novgorod and is busy launching production of a new saloon car. Its trucks, buses and other commercial vehicles are still in demand in the market. Explanations from Vladimir Torin, group communications manager.

France-Russia Automotive: You have just bought the

Daimler–Chrysler factory to manufacture the Chrysler Sebring under the

name of Siber. What is your policy with suppliers for this project?

Vladimir Torin: We want to offer Russian consumers a Russian car even if

the model uses western technologies. Currently, Chrysler suppliers are

obviously working with us. We are seeking to replace them one by one but

without sacrificing quality. We think it is possible to relocate parts

manufacture. Even though, for the moment, its less expensive to import

them, without import taxes under the Decree 166 rules, than it is to

produce them in Russia.

In any case, we can not do everything ourselves. We have already planed

to build a factory at Nijni, in partnership with Magna. We are also

going to obtain an Italian engine from VM Motori (who already supplies

engines for LDV's Maxus van, owned by Gaz – Editor). We are looking for

hundreds of partners.

- What sorts of partnerships do you prefer?

- The most profitable! We are open to all proposals, all types of

partnerships including joint ventures. Just one condition: we must

participate in the project and not simply be purchasers.

- GAZ has occasionally suffered from not having appropriate engines.

How are you going to resolve this problem?

- We have developed an internal engines division and we should shortly

have a full range of diesel engines for all our vehicles which will be

manufactured in our Yaroslavl and Ulyanovsk factories. With the Austrian

company, AVL, we are going to install a new engine production line at

Yaroslavl.

- What are your international development plans?

- We can not attack the European market which is too restrictive in

terms of quality. However, we are ailing at Asia and Latin America.

Hungary, Bulgaria a,d Romania are also part of our traditional markets.

Our Gazel van has had a good reception on the Turkish market. 5,000

units have been exported to Turkey and we are shortly going to build a

local assembly plant there. We have also a project on the drawing board

to build an assembly plant in Romania with a local partner.

l Who is GAZ?

The Nijni Novgorod motor plant,

which was built by the Ford Motor Group during the 30s, remains the

centre of the GAZ group, one of the leaders of the local automobile

sector. The group produced 273,000 vehicles in 2006: cars, commercial

vehicles, trucks and buses and specialised vehicles. Sales revenues were

4.05 billion dollars in 2006.

http://eng.gazgroup.ru/

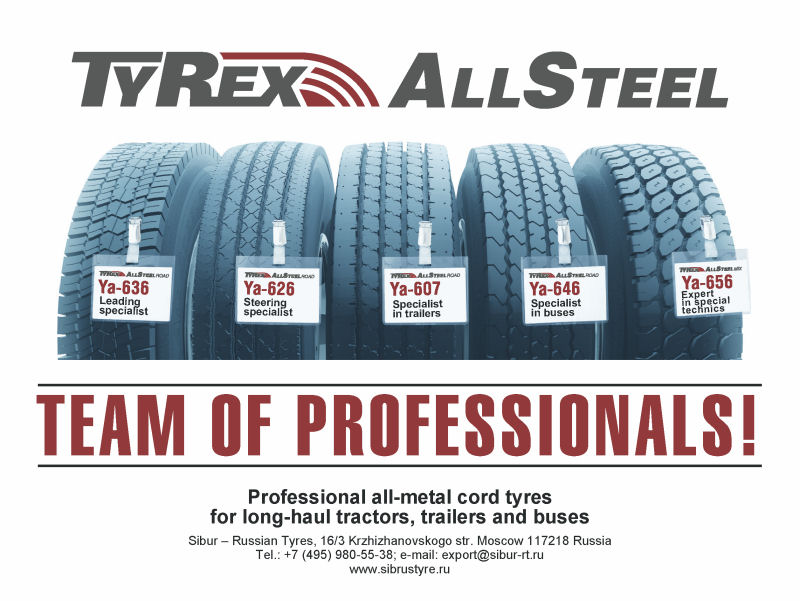

SIBUR – RUSSKIE SHINI IS AIMING AT INTERNATIONAL MARKETS

Sibur – Russkie Shini, one of Russia's largest tyre manufacturers, has just undergone a major reorganisation. It is now a bit more independent from its parent company, Gazprom, and is aiming to find new markets in Europe and Africa for its truck tyres and is seeking partners for its car tyres. Interview with Aleksey Evteev, head of the Sibur – Russkie Shini communication department.

France-Russia Automotive: What

is your view of the tyre market?

Aleksey Evteev: We expect all the overall tyre market to increase by 15%

in value and 7% in volume per year until 2010. The internal truck steel

tyre market is sufficiently large for us and our competitor, the

Nizhnekama factory.

In addition, we export tyres to central Europe. We are seeking to

conquer new markets and have opened satellites in Germany with others

planned for Holland, North Africa and the Near East. Michelin's Cormoran

range is our main competitor on these markets. But our range is almost

50% less expensive...

- What part of your business is in the manufacturer fitted sector?

- We are present in Avtovaz, Kamaz, UAZ, GAZ. And also supply the

Renault Logan, the Kia Spectra and the Ford Focus in GM Avtovaz. There

are discussions with Volkswagen. Manufacturers provide a minimal margin

but we prefer to maintain this business in order to create customer

loyalty.

- Sibur has just been restructured as a holding which is less

dependent on Gazprom than it was previously. What impact has this had on

how Sibur – Russkie Shini is organised?

- A strategic centre was created within the management with managers

from leading companies: TranMashHolding, Russkie Mashini, Russal, etc.

The role of this new service is to start new production that meets

European standards with a central focus on quality.

On the industrial front, most of the factory equipment has been renewed

mainly using Japanese suppliers. Sibur is currently closing its old

production lines in the C tyres segment and those for obsolete truck

models with a progressive conversion to 'all-steel'. This reorganisation

is partly financed by our own capital and partly by loans.

- How is the commercial department organised?

- Since the reorganisation, every factory has had a sales department

called 'Filiale Russkie Shini' located within the factory. Each

subsidiary is responsible for several regions. Each regional

distribution network must only have contact with its relevant sales

department and be supplied from its factory. Our aim is to avoid

factories competing with each other, subsidiaries competing with each

other and price dumping provoked by clients.

Major accounts worth over 20 million USD buy directly from us, including

the Ministry of Defence, Ministry of Emergencies and companies such as

Norilsky Nikel. Clients worth less than 20 million USD buy from the

factory sales subsidiaries and from a specific sales department for

Moscow. We manage our own logistics with a fleet of trucks.

- What is your payment policy?

- A new distributor must pay cash until payments reach 1 million Roubles,

about 40,000 USD. Once this threshold is reached, the distributor is

considered reliable and can obtain payment terms. The terms are variable

deepening on the degree of confidence that we have in the distributor.

It may be greater than six months for some. Our most reliable and loyal

clients can also get discounts of up to 15% and payment terms that are

even longer.

- What do you think of the sector lobbyists such as AEB?

- We participate in these structures because we have realised that we

and our competitors have 80% of common interests. Igor Karavaev, our

strategy and development Director is a member of Chamber of Commerce

sub-committee. We are also a member of the Association for European

Business. This organisation provides us with a means for lobbying but it

is also a good channel for communicating with European partners.

- How do you approach partnerships?

- We work with Matador - Continental and other partnerships are planned

including for the HGV range. We are regularly contacted by potential

partners. We can also envisage a minority partnership for HGV where we

will provide our manufacturing capacity and staff. This could involve

production in our factories by replacing our old production lines or

'green field ' projects. We can also envisage 50/50 partnerships for

truck tyres. Furthermore, we are not going to limit ourselves to just

one partner but will develop by niches: one factory, one partner... In

this respect, we are better off than our competitor Nizhnekamskshina

because their business is dependent on a single production site.

l Who is Sibur – Russkie Shini?

Sibur – Russkie Shini is part of

the Sibur holding, a petrochemical specialist and Gazprom subsidiary. It

is one of the leading tyre manufacturers in Russia with its four

factories at Yaroslavl, Volgograd, Omsk (Omskshina) and Yekaterinburg (Uralshina).

The company claims to be the only manufacturer of 'all-steel' truck

tyres on the market. It also makes aircraft tyres, tractor tyres and

other tyres for specific markets.

Following a loss of 19.3 million dollars in 2005, Sibur – Russkie Shini

reported profits of 19.2 million dollars in 2006.

http://www.eng.sibrustyre.ru/main.shtml

IN PRACTICE

THE BEST SALES OF FOREIGN BRANDS

Sales

of imported and locally assembled foreign makes of car were over one

million units during the first 8 months of 2007 according to the AEB.

Amongst the leading brands sold in Russia during the first 8 months of

2007, Chevrolet tops the list with114,964 units (including the models

manufactured by the joint venture with GM-Avtovaz). Ford is second with

105,858 cars. Toyota sold 99,503 units. Hyundai with 80,477. Nissan with

72,437 cars. Renault was sixth with 62,588 units sold

In terms of models, the Ford Focus is the leader with 59,521cars sold

during the first 8 months of 2007. Renault Logan achieved 42,418 units.

They are followed by the Chevrolet Lanos (37,316), Daewoo Nexia (31,467)

and Toyota Corolla (29,468). The Chevrolet Niva was sixth with 29,311

units sold.

Three of the models on this list are manufactured locally: Focus at the

Ford factory at Vsevolozhsk, Logan at the Renault Avtoframos factory at

Moscow, Chevrolet Niva in the GM-Avtovaz joint venture plant at

Togliatti. Two others are assembled in the CIS: Daewoo Nexia in

Uzbekistan, Chevrolet Lanos in Ukraine.

SECOND-HAND EUROPEAN CARS FETCH GOOD PRICES

Imports of new and second-hand

vehicles reached almost 832,000 units during the first 7 months of 2007

according to the Russian Customs statistics. About 86,000 of these came

from CIS member countries consisting mainly of the Chevrolet Lanos

assembled in Ukraine and Daewoo Nexia assembled in Uzbekistan.

Second-hand vehicles imported from Japan represent about a third of the

non CIS import market. The average age is three to five years and their

average price declared to Customs is about 12,000 dollars. The Hyundai

and other South Korean KIA represented almost 70,000 imported vehicles

during the first 7 months of 2007 with an average price of 10,000

dollars.

European origin vehicles are amongst the most expensive especially

German vehicles. For many drivers, it is more prestigious to drive a

second-hand vehicle from a major European manufacturer that to have a

new vehicle from further away.

THE MOSCOW CAR FLEET IS RENEWED BY FOREIGN BRANDS

The exponential growth in the

Moscow car fleet is mainly provided by foreign brands. This is the

conclusion of a report completed in August-September 2007 by the

Avtostat agency. According to the report, 280,000 out of 355,000 new

vehicles registered in the capital during 2006 were foreign brands,

equivalent to 79%. The trend is similar for the Moscow region but less

strong: 160,000 new car registrations with 65% of them being foreign

brands.

Statistics from the Interior Ministry highway police seem to confirm

this trend: from 900,000 foreign branded vehicles registered at the

start of 2004, the number has grown to over 1.67 million by mid-2007

with a reasonable forecast that this will reach 1.7 million by the end

of 2007.

The total number of vehicles of all types in the capital is 3.5 million.

The locally designed Lada is still the leader: nearly 1.1 million units.

There are still 500,000 obsolete locally designed vehicles which are no

longer manufactured, in most cases: GAZ, Moskvich, ZAZ…

About 25.1% of the cars registered in Moscow are less than three years

old and 21.8% of the fleet are between three and seven years old. Over

half the fleet is over seven years old. 36.9% are over ten years old;

these are mainly locally designed vehicles but include a few foreign

brands that arrived as second-hand imports, especially German makes. The

general trend is for the fleet to become younger: more and more drivers

in the capital are choosing a new vehicle rather than buying

second-hand.

Ford is the leading foreigner at Moscow with 139,769 cars registered by

mid-2007. They are followed by Toyota (139,184), Volkswagen (123,793),

Nissan (111,458), Mercedes (105,483) and Mitsubishi (105 007). Renault

is 12th in the capital with 58,710 units according to Avtostat.

Ford's first place is due to its excellent sales results with the Focus

assembled in its factory near St Petersburg: its 35,893 vehicle sales in

Moscow in 2006 gives Ford 10% of new foreign vehicle registrations. They

are followed by Hyundai, Nissan, Toyota, Mitsubishi and Renault. There

is a strong showing for locally assembled vehicles: Ford, of course, but

also the Hyundai Accent from the Taganrog factory and the Renault Logan

from the Avtoframos factory in Moscow.

The truck fleet in Moscow and its surrounding region is being renewed

slowly. According to Avtostat, whilst Scania, MAN, Renault,

Mercedes-Benz, Volvo, IVECO and DAF are regularly registered, they are

mainly second-hand imports with an average age of three to seven years.

TYPICAL PURCHASER

Does a Russian consumer behave

like his/her European counterpart when buying a car? The typical

purchaser, described by the Association for European Business in 2006,

provides an accurate answer. The average age of a new car buyer is 37

years old in Russia compared to 46.7 in Europe. Retired people represent

only 4% of them compared to 21% in Europe.

84% of buyers are men (69% in Europe) and 74% of them are married or

living in a couple (75% in Europe) and their household consists of 3.3

people compared to 2.8 in Europe. About 56% of drivers are one-car

households (45% in Europe). Its the level of declared revenues that

shows the greatest difference: 20,800 dollars per year in Russia

compared with 46,300 in Europe.

12% are buying their first vehicle (only1% in Europe). Almost 77% of

drivers intend to use their vehicle for travelling to and from work and

48% for business purposes (70% and 33% respectively in Europe).

STRATEGIES

TAGAZ: 'We require lower prices from local suppliers than those of the Koreans'

Despite difficulties in delivering kits from Hyundai, the TAGAZ car plant at Taganrog, in the Rostov region manufactured 56,000 vehicles in 2006 and had sales that was almost 433 million dollars. The factory was built in 1998 to produce three Daewoo models under its own brand of Doninvest as required by its owner, Mikhaïl Paramonov. However, Daewoo's well reported problems and the Russian financial crisis led to production stopping. 'We then started assembling the Citroën Berlingot commercial vehicle. The idea was good and several Berlingot are still used today as taxis in Moscow. And demand for commercial vehicles is growing even faster than demand for cars. However, at the time, the demand was not sufficient and the model chosen was not one of the cheapest. Whatever the reasons for us and Citroën going our separate ways, the market was not yet ready for this type of vehicle at that time' explains Ivan Karpouzov, TAGAZ communication manager. The company has assembled Hyundai vehicles since 2001 and should soon assemble the 150,000th Accent according to a spokesperson. 'We had a few delivery problems especially with engines but the brand has agreed to deliver more. They have promised to provide us with 80,000 kits next year. Our total capacity means we can assemble up to 120,000 vehicles plus 30,000 Porter commercial vehicles assembled on a separate line. Only Ford and Avtoframos can claim greater volumes than us for the future' he confirmed. TAGAZ has planned to locally source components but for small volumes such as tyres and discs for the Accent. 'We are working on this with the Nizhnekama tyre factory and Pirelli. We are also making seats because they are large parts and too expensive to deliver. We plan to source plastic parts locally. We ask local suppliers to provide a constant level of quality at prices below those of the Koreans. However, we prefer internal production as that means we can manage both quality and production costs' added Ivan Karpouzov.

DELPHI: 'We are also relying on future implantations!'

The component manufacturer,

Delphi, has created local partnerships including with the SOK group, to

supply parts for specific models promised for the Russian market by

global manufacturers. There is no shortage of projects. The company has

developed OEM contacts with local manufacturers such as Avtovaz, Gaz...

'We have created a cable factory at Samara with the local manufacturer

SOK (see later - Editor). We are also producing connectors

together. SOK is a good and reliable partner. We are also discussing the

possibility of a partnership with a gearbox factory as a joint venture'

said Steven Gaut, Delphi Powertrain Systems Marketing Director. The

component maker has a confident approach to this market. 'The Russian

market is no more difficult than South America or Japan. We practice the

same methods everywhere, developing a special relationship with a local

partner to learn about and understand the context in terms of politics,

economy, human resources, etc.' explains Steven Gaut. Once the

management has been found, Delphi creates autonomous regional entities

with the initial investment coming from the parent company as a

complement to that provided by the partners. The local company then buys

a licence to obtain access to the technologies. 'This system is already

operating with SOK and we are negotiating with other potential partners'

added Steven Gaut. Currently, Delphi only has a limited presence in the

Russian market but this situation should not last long as new

opportunities are developing. 'It is not really very interesting to

establish partnerships for current models' affirmed Steven Gaut. 'We are

aiming more for the models to come because several manufacturers intend

to launch specific models for the Russian market. The regulations are in

the process of changing in Russia. They are now practicing the Euro 2

and Euro 3 standards for gearboxes. In Europe we are working on Euro 5

and preparing Euro 6. If the Russian legislation changes quickly, Delphi

already has the products that are required.

We are also counting on future implantations. PSA is going to build a

factory in Russia and they are our second largest client in Europe. Our

existing contracts for the 206 or the 307 are good opportunities for

adding extra volumes to the orders.'

SOK: 'Our 50,000 employees are ready to learn!'

'We are anticipating the arrival of foreign

manufacturers. Those who enter the Russian market prefer to work with

their existing suppliers initially or look for local sub-contractors

that can meet their criteria. This is where we are positioned. All our

factories are ISO 9001 certified. And we have a manpower reserve that is

ready to learn with over 50,000 employees' stated Dimitri Roumiantzev,

department head for the SOK group, local car component specialist,

amongst other things..

Dimitri Roumiantzev agrees that the group factories have had a few

problems with maintaining constant levels of quality. SOK is planning

projects with European or Asian partners to improve its production

quality; especially with car component joint ventures. There are ongoing

projects with the German, Halla, for headlights and Pegaform for

plastics. The Delphi partnership appears to be working well (see

earlier - Editor).

The group originated from Samara and had sales of 2.4 billion dollars in

the automobile sector in 2006. Its development is centred on several

axes including automobile manufacture and component production. The

Izhavto assembly plant has produced Kia models since 2005, the Spectra,

Rio and Sorento four-wheel drive, plus the Izh minibus. Some of the

Spectra components are locally produced. The Vazinter plant continues to

assemble old Avtovaz models. The Roslada assembly plant is stopped and

looking for a partner.

SOK has 15 to 20 factories for components in different regions. It

supplies Avtovaz, GM-Avtovaz and Ford for some factory fitted

components. Group companies are also in the Volkswagen catalogue for its

planned factory.

SOK is also Kia's exclusive distributor with over 100 outlets and also

distributes a dozen other brands.

The group is also developing in the construction sector: building

bridges, tunnels, roads and factories. This sector is enjoying rapid

sales growth and its share has increased to 20%.

IRAN KHODRO: 'We plan to create our own subsidiary in Russia'

The Iranian car manufacturer, Iran Khodro, forecasts that 15% of its production will be exported in 2007 (637,000 vehicles) to 39 countries and this will reach 25% and over a million vehicles by 2010 according to its chief executive. Algeria, Egypt, Jordan, Lebanon Syria, Turkey and the Central European countries of Bosnia, Bulgaria and Croatia are currently the main markets. However, the company's priorities are the Middle East and CIS markets. Iran Khodro has been present in Russia for two and a half years and has sold 10,000 cars, mainly the Samand. 'The general growth of the Russian market is beneficial to us. Our sales have shown rapid growth in 2007 with a forecast of 15,000 vehicle sales. This significant progress is due to an exclusive partnership with the wholesaler, Autofriend, who has done excellent work. Currently, the vehicles mainly come from Iran. After numerous evaluations, we have concluded that the best route is to load vehicles at Anzani and unload them on the other side of the Caspian Sea at Astrakhan' stated Alireza Mirzaei, vice-president Export and International for the Iranian car manufacturer, Iran Khodro. There are many projects. 'Apart from the Samand, we intend to shortly launch the renewed version of the Soren with the objective of selling 5,000 during 2008. We are also looking at the possibility of opening our own subsidiary in Russia. However, this will only become a reality once we are certain that this will not harm the interests of our partner, Autofriend' confirmed Alireza Mirsaej. The chief executive admits that setting up a company in the Russian market can be difficult, especially with the regulations. 'Amongst the difficulties that we met when trying to get started in this market, I think the most difficult was obtaining Russian regulatory conformity certificates. Even if this is an obligation for every market when we want to get started, this required a lot of work. In a general sense, exporting was a new experience for us two years ago and we had to learn everything' he explained.

Alain Bastid

BRIDGESTONE cultivates a good citizen image

Bridgestone is selling via the

Pole Position regional wholesalers and stores network: 70 sales outlets

with two pilot stores in Moscow and the rest as franchises. The

franchise specification includes at least two fitting workstations, a

storage area and a minimum surface area. 'Our stores sell 5 -10% of

products from other manufacturers including the Nokian and Gislaved

winter ranges (Editor - a Swedish Continental brand). These sales are

justified by clients who are used to these brands for winter tyres'

attests Mikhaïl Lavrenov, director of the Bridgestone Pole Position

Varshavka pilot store. The Pole Position stores only sell Bridgestone

products in the summer range as these ranges are well developed.

The tyre manufacturer does not supply any of the car manufacturers. It

was in negotiation with GAZ a few years ago with a view to equipping the

Gazel but the discussions were unfruitful.

Bridgestone cultivates a good citizen image in Russia. They have

translated a road safety campaign into Russian, the campaign leaflets

are given out to Russian drivers in the Pole Position stores.

AMTEL-VREDESTEIN is demonstrating the difference between it and its Russian equivalents

Despite high debts, the company is trying to continue its development and is targeting the A segment.

Amtel-Vredestein does not do

anything in the same way as other Russian tyre manufacturers. Whilst its

major competitors, such as Sibur - Russkie Shini and Nizhnekamskshina,

have recently started claiming to be receptive to foreign participation

to bring them up to international standards faster in terms of

technology and marketing, Amtel bought the Dutch tyre maker Vredestein

in 2005.

The acquisition of Vredestein by Amtel has meant it could achieve its

strategic objectives very early. Firstly, acquire western know-how and

technology. Secondly, create cross-fertilisation with Dutch specialists

especially when designing and commissioning the Voronej-2 factory.

Finally, own a western brand which was essential for its position on

segment A in the Russian market.

Amtel was the first Russian manufacturer to start developing an

integrated retail network in 2006. Its Av-To network now consists of 94

outlets to which the wholesalers, Pigma and Megashina, should be added.

Whilst the future of the AV-TO network as an integrated structure is now

suspended awaiting the strategic decisions of the new management, the

relevance of the concept is not in question.

Amtel currently claims to be the first Russian manufacturer to launch a

full range of tyres of the A segment. Vassily Ignatiev, The tyre maker's

marketing director, confirms that this range should be launched in

Russia before the end of 2007 with significant publicity and marketing

budgets: 'We could not do it sooner because we did not have a full

range, an essential factor for attacking this segment. The tyres from

Vredestein's European range must be adapted tithe Russian market where

we use different nails and rubber-mixes. We are now ready and we are

launching with significant marketing and publicity budgets coupled with

the advantage of a Dutch trademark. We aim to obtain 6 - 7% market share

by 2011 compared to just 0.7% currently.'

The future is uncertain. Company results were much better in 2006 with

sales of 823 million dollars, a year on year increase of 23%, with

losses reduced from 81 million in 2005 to 7 million dollars. The results

for the first half of 2007 confirm this upward trend with a 30% increase

in sales revenue. However, the level of debt remains very high and

continues to impact the results.

The distribution network is currently undergoing a drastic reduction

with about twenty sales points having been closed and may be sold. An

alternative to this is to seek a foreign partner who could provide

liquidity and know-how.

Alfa Bank has recently taken control and replaced Samir Gupta, the

ex-main shareholder. Petr Zolotarev, who was DG at Russkie Mashini, was

named CEO and replaced Alexei Gourin. The financial director has also

been replaced. Petr Zolotarev, 42 years old, is an economist by

training. Following his education at Moscow,, London and Lausanne, he

has mainly worked for Ioukos where he climbed up the company to become

president of Ioukos RF and group board member. Since 2005, he has

demonstrated the profile of a westernised manager at Basovy Element as

General Manager of this Russkie Mashini holding.

Without prejudging his future decisions, it is to be expected that they

will involve far greater financial thoroughness than in the past.

Already, some services have relocated from the Amtel head office on the

prestigious Avenue Koutouzovsky to the offices of the old Moscow Tyres

factory with its interior decor that is reminiscent of the USSR of the

70s, located in a working class district.

The strategic choices for the rest must be made quickly by Petr

Zolotarev, according to the analysts who monitor the shares: what should

be done with the Moscow factory that is currently almost at a

standstill; what should be done with the AV-TO retail network; is it

useful or necessary to have foreign groups enter the capital of the

group's factories; etc.

Alain Bastid

l Amtel's dates

1999: Amtel takes a share in the Kirov tyre factory then buys the Voronej tyre factory followed by the Kemerovo chemical fibre plant.

2004: Amtel launches the Planet range and NordMaster winter range of tyres..

2005: Amtel Holdings Holland N.V. Vredestein Banden BV purchased to create the Amtel-Vredestein NV group, the first Russian company to be quoted on the London Stock Exchange.

2006: The AV-TO network purchases the wholesalers Pigma (spare parts) and Megashina (tyres). Amtel buys the Moscow Tyres factory. Sales increase by 23% to 823 million US$.

2007: Faced by the excessive increase in debt, shareholders name a new management. Samir Gupta sells his shares on the market and now owns no more than 11% of the voting rights.

www.amtel-vredestein.ru

l Vassily Ignatiev's advice for foreign companies that are interested in Russia:

- Be ready to change tactics as the environment and circumstances change.

- Russia must be approached as an emerging market with more risk than others. It should be considered as part of a portfolio which should be balanced at the end of the year but where incidents can occur from time to time. This is its normal way of working.

VIANOR: 'Don't try and transfer your existing programmes into this market! Adapt…'

Tyre maker Nokian has chosen to use franchising to help its auto centre network , conquer the Russian market. A concept that the tyre maker now plans to use for other markets.

Nokian, the Finnish tyre maker has

just opened its 100th tyre centre under the Vianor name in Russia. In

common with almost all the Vianor outlets in Russia, its a franchised

centre located at Naberezhnie Chelni in Tatarstan. The company has used

Russia to test its new development strategy. The Vianor network counts

45 - 60 outlets with 6 - 7 franchises in each of Finland and Sweden. In

Russia it has two outlets and over a hundred franchises and is present

in 69 towns.

The first Viador centre in Russia opened in Rostov in 2005. 'At the

start we identified about thirty towns in Russia where the population

was greater than Helsinki (half a million) and we wanted to target these

towns as a priority. We quickly realised that we needed to be more

ambitious' reminisced Seppo Kupi, Vianor Holding general manager.

'Russia was the test bed for developing franchises for Nokian. However,

we intend to progressively add to our own outlets possible to have one

in every large town where they will play the role of pilot outlets'

explained Andrei Pantioukhov, Vianor's Russian general manager.

According to Seppo Kupi, 'Vianor does not plan to greatly increase the

number of owned outlets globally. Future development will be via

franchises as in Russia'. Its rapid growth in the Russian market has

provided the manufacturer with an opportunity to abandon its historical

model and to test a new way which will now be applied in other

countries.

Rafaïl Badretdinov, joint owner, with his son and nephew, of the Brinex

network is a new Vianor franchisee. He now has six auto centres in the

Kama region: at Naberezhnie Chelni, Almetievsk and Nizhnekamsk, near the

huge factory of local tyre maker Nizhnekamskshina. It's not easy to

offer the Finnish brand under these conditions. 'At the start we

wondered how we could compete with products from the local factory. The

regional markets are inundated with Nizhnekama tyres which have not

always followed a legal distribution route and are sold at very low

prices. Consumers were not used to paying higher prices or to paying for

services. It is difficult for us to sell a lot of Nokian tyres but we

are trying to keep them at 60% of our sales'; confided Rafaïl

Badretdinov. The network requires that the share of Nokian tyres and

Nordman winter tyres does not fall below 60% of sales.

Storage, the leading service

Dedicated tyre centres in this country with a hard climate have two

periods of seasonal demand when drivers replace summer tyres with winter

tyres and vice-versa. The rest of the year, the level of activity is

much lower hence the need to develop other services. 'We want to develop

complementary services for the inter-season, cleaning, oil changes,

battery replacement, etc. This selection of services is not exhaustive

and can be adjusted depending on the ability of each partner' added

Andrei Pantioukhov.

Another service that is enjoying a lot of success in Russia: storage of

winter tyres between seasons by the auto centre. Drivers do not want to

dirty the inside of their vehicles by carrying their tyres and lack

space to store them in their homes. The service included cleaning the

tyres, wrapping them in plastic film, labelling and storage. It also

means that the centre is certain that the client will return at least

for the next season.

'We have a capacity for about 1,500 units in total and there is no

distinction between our products and those being stored. When our

storage capacity is exceeded, we send our clients' tyres to a dedicated

central depot. The service has been so successful since it was launched

that we are busy looking for new storage sites' comments Raphaïl

Badretdinov.

Andrei Pantioukhov plays a double role in his relations with the

franchises: Vianor manager and also general manager of Nokian Shina, the

Finnish tyre maker's local subsidiary which has a factory near

Vsevolojsk, in the St Petersburg region that produces 4 million tyres

per year. This factory produces 70% of the Nokian and Nordman tyres sold

in Russia.

This is a fairly comfortable situation for controlling the special

conditions offered to the franchises.

The tyre maker offers better prices and payment terms to its franchises

than those offered to distributors. Delivery is free anywhere in Russia

once a minimum volume is exceeded. Finally, franchises have a delivery

priority when products are out of stock.

The company has implemented a travelling Vianor School in June 2007. Its

role is to train franchise directors, sales staff and mechanics. The

training is jointly financed 50/50 by the company and its partners who

decide themselves who they send for training to increase staff

retention. Vianor is also working on an incentive programme project for

the employees of its Russian partners.

However, the tyre maker's local subsidiary does not underestimate the

problems of franchising. 'Sometimes our partners are not ready to

increase the number of sales points. We can help them including

arranging the necessary financial support. If this is not enough, we can

then look at having several partners in the same region. In another

case, their respective zones overlap, e.g. at the edges of two regions.'

commented Andrei Pantioukhov. Use their experience to advise western

operators who want to enter the Russian market: 'Don't try to transfer

your existing programmes onto the Russian market. Be ready to adjust

your programme to the interests of your future partners.'

Nokian Tyres has sales of 432.5

million Euros for first half 2007. Nokian sales in Russia and the CIS

increased by +52.1 % during the same period (+23.8 % for all countries).

Russia now accounts for 34% of its total sales.

70% of the products sold in Russia by Nokian come from its Vsevolojsk

factory, near St Petersburg. This factory will be enlarged to eventually

contain six new production lines and increase its capacity from 4 to 10

million tyres per year by 2011. Nokian Russia's investment in 2007 will

be 110 million Euros with 62 million of this being for enlarging the

factory.

www.nokiantyres.com

The Vianor centres network

developed considerably at the end of the 90s. Its development was marked

by the purchase of Isko Oyj in Finland in 1999. Currently Vianor Holding

is a 100% owned Nokian Tyres subsidiary with 298 centres in 8 countries

of which 130 are franchises and the rest are owned outlets. Vianor is

aiming for 120 centres by the end of 2007 in Russia and up to 300 by the

end of 2009.

Vianor is also involved in commercial vehicles. According to Seppo Kupi,

sector VI accounts for 25% of the network's sales in Scandinavia with a

50/50 mix between new and retread tyres. Vianor has a specialised sector

VI new and retread centre at St Petersburg near the Shushari retread

factory. Some of the Russian centers will also offer sector VI tyres.

vianor.ru

IN BRIEF

MARKETS

- The market for private vehicles in Russia could exceed 90 billion

dollars in 2011 compared to 45 billion in 2007 according to a forecast

produced by the local PriceWaterhouseCoopers team. The forecast

considered that disposable income would continue to rise, the share of

vehicles sold with finance would increase from 25% currently to 50% in

2011 and the average price of a vehicle would be nearly 20,000 dollars.

With forecast sales of 4.5 million vehicles in 2011 this would make

Russia the leading market for car sales in Europe. A forecast that does

is not making in optimism.

- Local production of foreign brands should reach one million units by

2010 and provide sufficient volumes to attract international component

makers to set up local production according to the AEB's Automotive

Components Committee.

- Truck sales in Eastern Europe markets should reach 100,000 units in

2010 with half of these being in Russia according to analysts at

Merrill Lynch.

COMPANY LIFE

- The Nissan Motor Rus factory in the St Petersburg region should

produce its first vehicles in May 2009. The site's forecast capacity is

50,000 units per year. Nissan is planning on sales of 110,000

cars in 2007, compared to 75,500 in 2006.

- British company Stadco could double its investment in the

bodywork parts factory in the St Petersburg region. The budget could

increase from 100 to 208 million Euros according to the latest

information. The factory should start producing at the end of 2008 and

have a capacity of 100,000 kits per year to begin with but with

expansion plans through until 2015 already prepared.

- The American Johnson Matthey inaugurated its catalytic

converter factory at Krasnoyarsk this year. The company decided to set

up next to KrasTzvetMetal, its partner for the last ten years. It

will take advantage of the technologies and trained staff that are

already available locally.

- The planned General Motors factory at Shushari could start

producing a new low-cost model, reportedly designed for the Russian

market, from 2009. In the meantime the factory will start assembling the

Chevrolet Captiva in November 2008.

- Avtovaz's market share should grow from 33% in 2006 to 28% in

2007, according to the financial daily Vedomosti. It was still at

38% in 2005. The biggest local car manufacturer is having difficulties

in competing with the western brands. It hopes to keep its market share

above 25% in the future but most analysts are forecasting something

nearer 20%.

- The average age of the equipment in the GAZ factory at Nijni is

25 years. Thanks to the efforts of the new management which includes

several European managers, the level of defects has been reduced tenfold

and more. However, the rate is still two and a half time greater than in

the European motor industry, according to group executives.

- The Avtovaz factory is frequently the victim of theft. Local

police arrested thieves in August 2007 as they were trying to leave with

three trucks filled with spare parts stolen in just one night, a haul

worth almost 460,000 Euros. Catches of this sort are not rare and theft

is considered to part of the routine in this factory.

- The SeverstalAvto group intends to develop its own network with

a dozen distribution and service centres across the country. The first

should open at the end of the year. SeverstalAvto produces

four-wheel drive vehicles under the UAZ Patriot brand and

assembles Ssang Yong four-wheel drive vehicles, Isuzu and

Fiat Ducato vans.

REGULATIONS

- The Euro 3 standards will apply in Russia from January 1st

2008. However, two local manufacturers, Kamaz and Izhavto

(SOK group) have asked that their application be delayed.

Izhavto still assembles old Avtovaz models. These models were

designed in the 70s and require too many changes to make them comply

with the new standards.

- The Russian parliament is evaluating the possibility of

allowing foreign car manufacturers to propose finance deals in sales

outlets using their own financial companies. Currently most

manufacturers have to use a local bank as a partner. Changes to the

legislation could occur before the end of the year.

AGENDA

- Autoinvest 2008

February 11th to 12th 2008 at St Petersburg

A conference for investors interested in car component production in the

region.

eng.autoinvest-russia.ru/

- Automechanika

March

4-6th 2008 in Moscow

The second edition of the International Exhibition Automechanika will be

organized in Moscow by the German Messe Frankfurt. Automechanika May

2007 edition attracted more than 200 exhibitors from some 20 countries.

It focuses on service stations, car equipment, accessories and services.

The 2008 exhibition will also comprise a conference covering Russia’s

automotive industry, OEM suppliers and aftermarket sales issues.

www.automechanika-expo.ru/eng

- Tires and Rubber

March 4-7 2008 in Moscow

Located on the same exhibition centre as Automechanika, this smaller

local event will gather Russian and international tire manufacturers,

wholesalers, as well as some special equipment manufacturers.

www.maxima-expo.ru

- The Russian Automotive

Industry

March 11th - 13th 2008 at Moscow

An international conference organised by the Adam Smith Institute.

Interventions are planned from the main players from the local and

international industry. You can meat the cream of the leaders in Russian

automobile industry and their purchasing directors.

www.adamsmithconferences.com

To receive the next issues of the France-Russia Automotive/Auto Franco-Russe, fill the subscription form : www.autofrancorusse.fr

La maquette de l'Auto Franco-Russe a été réalisée avec le concours de l'agence Vingt-Quatre Graphisme